Pmcm stock a buy

The objective is to identify marijuana stocks trading at calendar year-end lows, and on high volume, heading into For the long-term, recall what happened this election year, as you look forward toand consider buying selected marijuana stocks in December Joe Kerner, on CNBC, was discussing "the January effect" on today's program.

This is my follow-up to an earlier Seeking Alpha article. You should read this earlier article first. Alternatively, pick up any used copy of The Stock Traders' Almanaca Wall Street classic.

You can also read this article, to see how marijuana stocks did a few years ago. This is a marijuana breathalyzer firm with a good balance sheet and a great research team. The price-per-share has been bouncing around in recent days, and within this trading range.

This remains my favorite marijuana stock. Consider buying Breathtec Biomedical, a firm using the same research team and technology, but not a marijuana stock, per se. This could be a 3 year long-term buy-and-hold, but the price-per-share will bounce around quite a bit, allowing you to average down, just in case your entry price is less than optimal.

Consider buying Bayport International, but only as a "trade.

U.S. MILITARY ABBREVIATION AND ACRONYM LIST.

I have already traded this stock for a double and am holding a bit. They have had news releases regarding their move into the marijuana sector, with more anticipated on or before January 27, If you buy this stock, set GTC sells at your target price, immediately after purchase. I provide an example of what to look for this week. Simply [1] print out the list of stocks, [2] identify those you are most interested in, [3] scan the charts for relatively low entry points, and [4] pull the trigger.

Monitor on or about January 6 to see if you are seeing price recovery for a long-term hold. Most of the academic literature suggests a recovery of price-per-share on or before the 8 th trading day of the new year. See the below year-to-date chart from The Marijuana Index:. The objective is, now, is to buy, but based on any downside "over-reaction" for an early January recovery "January effect"once any tax-related selling pressures subside.

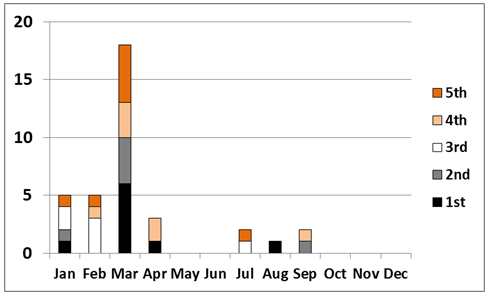

A few picks follow:. Cannabix Technologies has a strong team for their marijuana breathalyzer. It is no secret to my Seeking Alpha followers that I like this stock. Results have been favorable, so far:.

My core holdings were aboutshares, but I traded my average cost down before the last spike in price-per-share. I retain only 1, shares at this point in time. There did appear to be some manipulationIMHO, and it was at that point in time that I decided to take profits. Cannabix Technologies has a nice, clean balance sheet, a positive working capital position, and no toxic convertibles see SEDAR for this Canadian firm:.

The IHUB stock chat message board has some extremely knowledgeable posts and posters, but exercise caution. I have made an occasional negative remark and the moderators deleted my negative posts and even limited me to 1 post per day, so you are getting a positive and unbalanced view. I rarely post on this board, but observe or "lurk. BreathTec appears to be using the same technology used by Cannabix Technologies for their marijuana breathalyzer.

I have never owned this stock. Perhaps it is about time I bought and held some shares, but I would prefer entry at a lower price.

I am relying on [and hoping for] a lower entry price between now and computer trading stock market crash year-end.

Marijuana Stocks For Your Do Not 'Buy-And-Hold' List | Seeking Alpha

Breathtec Biomedical has a nice, clean balance sheet, a positive working capital position, and no toxic convertibles see SEDAR for this Canadian firm:. My attention was drawn to this stock by posts on the IHUB Cannabix Technologies stock message board posts. Many referred to both Cannabix and Breathtec as using the same technology, but could not understand why the stocks were not correlated with respect to price-per-share movements.

There are not that many posts on the Breathtec board, so I read all of them and posted the most informative posts to a Word file, printed it out, and spent a bit of time reading the posts and matching them to PRs and filings.

The most informative posts are 12, 22, 26, 32, 35, 40, 42, pmcm stock a buy, 51, 58, 69, 87,,andIMHO. It is about pages to print out and read and consider. Bayport International is moving into the marijuana sector or segment of the economy. Be patient - place a good til cancelled [GTC] "buy" order. Do not "chase" this stock.

I have already "tested" this stock and how it trades, here:. Below is the year-to-date chart, through December 16, You can match the above trade to the below chart:. Franks stated, "Bayport International will own and operate a very robust online cannabis directory in the coming weeks. The PRG team is making some very exciting adjustments to the platform in order to mbs trading strategy revenue potential.

We have announced that the business will begin operating as a Bayport International entity on or before January 27, I can tell you today that the PRG team has reported that we will not only meet that target, but will most likely be able to complete all components of the project much earlier than expected. Set a news alert, once invested, and look forward to santander exchange rates news releases with respect to progress on or before January 27, The firm has redesigned the website, here.

Financials are up-to-datebut fundamentals are horrible.

This, in and of itself, does not concern me, as those following my work understand that I have, frequently, noted that fundamentals are horrible for the vast majority of the marijuana stocks e.

Below is a graphic of the entire stock price history for Medical Marijuana. I added the 4 red arrows. This is the classic January effect that I would like to see occur.

However, in this case, Medical Marijuana is not a "loser" stock. Therefore, while it might rise in earlyany increase is not likely to be associated with "tax loss selling" from a losing calendar year:.

Medical Marijuana is enjoying a positive working capital position, though not from operations, and increasing revenues below:. To provide a comparison, below is a graphic of the entire stock price history for Cannabis Science. Again, I added the 4 red arrows. This is the classic "tax loss selling" followed by "January effect" sequence, but less significant when compared to Medical Marijuana above.

Again, Cannabis Science is not a "loser" stock. Again, while it might rise in earlyany increase is not likely to be associated with "tax loss selling" from a losing calendar year:.

Below is an example of a marijuana stock with a declining stock price. Again, I added the 2 red arrows. I would prefer higher volume, but it is negative or "sales. If I like this stock, I would monitor for the lowest possible entry price. These are the patterns to watch for between now and Friday, December 30, This article tells you how to "buy low.

You have already avoided a marijuana segment or sector down trend, if you sold on or about November 8.

Now, it is time to rotate back into the marijuana sector, buying low and feeling warm and fuzzy about your low entry point long-term buy-and-hold. Regardless of what you decide to do this week, do not miss out on low entry prices likely to occur during December If you identify and stocks trading low on high volume, and likely to recover early next year - after selling pressures subside - please let me and your other pals on Seeking Alpha know with a comment…after you buy in, of course.

Market capitalization measures were captured from the OTC Markets website. The marijuana sector or segment was developed from The Marijuana Index " Marijuana Stock Universe " as a starting point, as follows:. Some duplicated and triplicates were included on this website, so I eliminated them.

The end result was a net measure of U. An example of a triple-count follows from the website follows:. Quite a few of the stocks on the listing that I created for an earlier SA article, with data between February 14, and March 31,were no longer listed by The Marijuana Index, so I classified the sector as "Unclassified" in the "Marijuana Sector or Segment" column, and proceeded to record the number of Seeking Alpha followers for each stock on the list. APPENDIX B contains a complete listing of all marijuana stocks that I was able to identify, and also includes the number of Seeking Alpha followers.

If I missed any, please make a comment to this article, so that all will have a complete listing. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it other than from Seeking Alpha. I have no business relationship with any company whose stock is mentioned in this article.

Please be aware of the risks associated with these stocks. Long Ideas Short Ideas Cramer's Picks IPOs Quick Picks Sectors Editor's Picks. Want to share your opinion on this article? Disagree with this article? To report a factual error in this article, click here. Follow Anthony Cataldo and get email alerts.