Metal trading signals

America's trusted name in coin and bullion trading for 50 years. Market information and news is critical for precious metal investing. However, many investors have limited time to sort through the massive amounts of market data and gold, silver and platinum news.

The Monex Precious Metals Review consolidates the week's activities in a concise snapshot of the precious metal markets. Home Our Products Our Products Gold Silver Platinum Palladium Gold Gold Bullion Gold Coins Gold Vienna Philharmonics Gold American Buffalos Gold American Eagles Gold Canadian Maple Leafs 1.

Gold Canadian Maple Leaf Gold Canadian Growling Cougar Gold Canadian Howling Wolf Gold Canadian Roaring Grizzly Gold Canadian Bugling Elk Gold South African Krugerrands Silver Silver Bullion oz Silver Bullion oz Silver Coins Silver Vienna Philharmonics Silver American Eagles Silver Canadian Maple Leafs 1.

Gold Value Insights Other Video Library Why? Uncertainty in the Markets Why Own Precious Metals? Home Inside Info Precious Metals Review Market information and news is critical for precious metal investing. Sign up for free e-mail service.

Forex Trading Signals - reviews and ratings | DailyForex

Free Subscription Sign up for Free e-mail notification of precious metals market news Click Here To Get Free Subscription!

Let us help you: Account Representatives now available at PRECIOUS METALS REVIEW - June 16, In the precious metals markets this week QUOTES OF THE WEEK Want to know the latest on gold and silver in this age of uncertainty?

Mtechtips Equity & Commodity Advisor-Online Commodity Tips-Stock Market Tips-Accurate Stock Tips-Accurate Commodities Tips-Comex Market

Monex VP Mike Maroney offers analysis and commentary on recent activity in the economy, geopolitics and the precious metals markets. Check out video here http: They have entire institutional teams at their disposal, dive deep into the nuances and complexities of the market, and spend every waking moment of their lives thinking about how to get more from their investments.

They want to make money - but they also want to execute on strategies that will protect their wealth and build robust portfolios that can with stand any type of macro event. TURNING TO GOLD In recent months, some of these elite investors have turned to precious metals like gold as a part of their overall investment strategies.

Why are these billionaires buying precious metals? Their cited reasons can basically be summed up with six categories: Lord Jacob Rothschild In late metal trading signalsRothschild announced changes to the RIT Partners portfolio because he was worried about very low interest rates, negative yields, and quantitative easing, saying they are part of the "greatest monetary experiment in monetary policy in the history of the world.

Buy gold to help preserve wealth, and as a store of value for the future.

Forex Trading, Precious Metal Trading, CFD Trading Condition

David Einhorn Einhorn has a similar assessment. He believes that monetary policy is becoming increasingly adventurous, and that this - along with the policies of the Trump administration - will eventually lead to large metal trading signals of inflation.

In Februaryhe shorted sovereigns, and bought gold. Ray Dalio Ray Forex stop loss meaning is the founder of the world's top hedge fund, Bridgewater Associates and he's also no stranger to gold. Stanley Druckenmiller Druckenmiller, some people argue, is the best money manager of all time. Lately, he's placed his bets on gold as well, but for different reasons than the above managers.

Druckenmiller has always placed big trades with lots of conviction, and in February he put his money in gold because "no country wants its currency to strengthen.

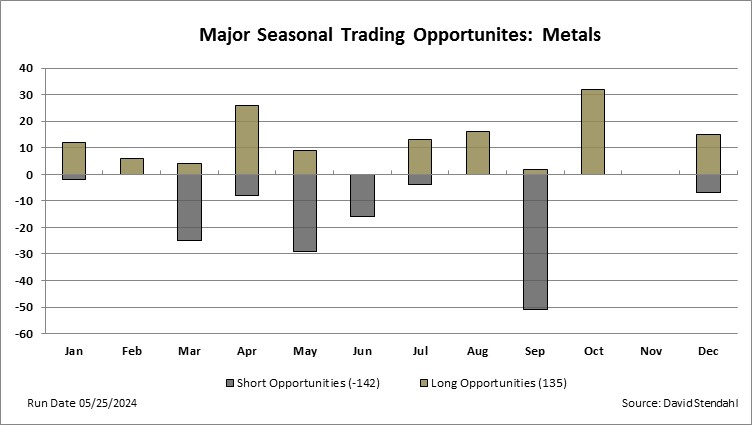

While seasonal trends hold true in most years there are certain years during which these trends are broken, over-ridden by specific events and developments.

This year maybe one of those years.

There is a lot of political uncertainty in the world at this time, which has the ability to negatively affect financial markets and increase demand for safe haven assets like gold and silver. There is also an expectation that the Fed may slow its pace of monetary tightening beyond its June meeting.

Trading Signals showcase in MetaTrader 4/5The precious metals markets have already run up a fair bit in the past couple of weeks in anticipation of the impact of various political and economic events.

Depending on the outcome of these events the value of safe haven assets may rise further or fall from their presently elevated levels. If these events do not negatively affect economic growth, some of the upward pressure on prices could come off and seasonal trends may have a stronger effect.

Any softness in prices should be treated as a buying opportunity as there are several unresolved political issues that could erupt at any given time and still disrupt economic growth be it Syria, North Korea, Russia's role in the U.

Some of these issues may deteriorate over the course of this summer, which should continue to underpin investor demand and counter the seasonal weakness preventing prices from declining sharply.