Forex stop loss meaning

Online Forex Trading and Broker Comparison at EasyForexTrading. Stop losses and take profit levels are used by forex traders to protect them from unnecessary financial risk and also to ensure that profits are taken for successful trades. Stop losses and take profit levels are both orders which are placed in the market to close an open position.

How to Place Stop & Profit Targets like A Professional » Learn To Trade

Traders following a particular strategy are likely to nominate their stop-loss and take-profit level at the same time as they enter the trade.

Whilst stop losses are employed by almost all forex traders, take profit levels may be seen as less essential, although they remove many of the problems faced by traders holding winning positions. What you should know in advance is that it depends on the Forex broker if a stop loss is executed properly.

Your best stop loss strategy is worthless with the wrong broker. We highly recommend to trade with a professional broker like Dukascopy that is one of the most reliable and fastest platforms out there. You should have a working trading account with a reliable broker like that before moving on. Click here to sign up with Dukascopy and take a look for yourself!

Stop losses and take profit levels are important in helping to remove the necessity to make emotional decisions during real-time trading. The psychology of trading suggests that markets are controlled by fear and greed. Whilst different traders will express different levels of how much they are willing to lose or gain from a trade, stop losses and take profit levels allow this to be mechanised.

This means that winning trades are less likely to turn in to losing positions and unsuccessful trades will not result in catastrophic losses. Stop losses are also important due to volatility that can occur in forex markets with sudden and unpredictable news and events which can cause large moves and cause heavy losses.

Although regular stop loss orders are not guaranteed, and can therefore be exposed to similar slippage in fast-moving markets, it is possible to guarantee stops with many brokers which can defend traders against these moves.

The first of these is how much risk they will expose the trading account to during each trade. The second factor is for the stop loss to be relative to the potential gains and therefore the take profit level.

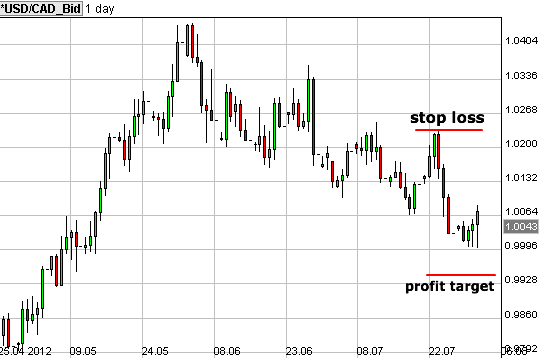

Ideally, the risk of losses on each trade should not be greater than the potential profits. Some experienced forex traders prefer to use technical stop loss levels in order to protect their accounts. The reason why these stops are technical is that they are usually placed at levels which would show that the trade has failed should they be triggered.

Amongst others, this could be above or below a key support or resistance level, pivot level or identified Elliot wave within a price chart. Even though technical stop losses may offer more flexibility to forex traders, they are generally only employed where the potential profit is anticipated to far exceed the loss that these stop losses represent.

Stop-Loss Order

Although it is considered unwise to get in to the habit of extending stop losses once the trade is active and as the price moves closer to the original level, most traders enjoy moving their stop loss to break-even once the trade moves in to profit.

By moving the stop loss to the entry price, a trade becomes almost entirely risk-free and allows the trader to focus entirely on the profit level that they require.

Employing a take profit order once the stop loss is at break even will assist with the difficulties of knowing when to close the trade. Home Introduction Broker Banking Basics Trading How to trade.

The importance of stop loss and take profit orders Stop losses and take profit levels are important in helping to remove the necessity to make emotional decisions during real-time trading. Technical stop losses Some experienced forex traders prefer to use technical stop loss levels in order to protect their accounts.

When a stop loss can be moved Although it is considered unwise to get in to the habit of extending stop losses once the trade is active and as the price moves closer to the original level, most traders enjoy moving their stop loss to break-even once the trade moves in to profit. Before we go into detail please be sure to select a reliable broker with a good platform that eventually does execute stop losses.

A good example is AvaTrade, one of the largest and most reliable brokers on the market. Trade with the market leader now: Plus is one of the most popular brokers and has an excellent customers service. Using stop-losses in forex trading Money management and forex success What Is Leverage and How to Use It Scalping made easy for Forex traders Trading using recent highs and lows.

Your capital is at risk. How to trade How to Hedge a Forex Account Tips and Tricks When Trading the AUDUSD Pair The psychological effects of forex trading Trading using recent highs and lows Technical v Fundamental forex trading Money management and forex success Developing a forex trading strategy The importance of adaptation in forex trading Trading the news The advantages of trading forex cross pairs Trading on multiple time frames Making the most out of candlestick trading strategies Can forex trading really be profitable?

Using stop-losses in forex trading Trading forex reversals Accurately trading forex divergence The difference between re-painting and non-repainting forex indicators Using price action in naked forex trading Forex Scalping Vs Swing trading The basics of candlestick trading What to look for in a forex broker Trading forex breakouts What are trends and how to trade them Using technical analysis in Forex trading Swing trading strategies for Forex traders.

EN DE ES IT FR AR.