Market depth forex trading

Moving from small time retail forex accounts to a serious account size comes with some bumps in the road.

Learn how to use the Market Depth

Most traders see the prices of forex pairs on the screen and assume that they can buy and sell unlimited quantities at any time. Although the forex market is the largest market of any in the world, making it the most liquid, there is still a limited size to what you can trade at any moment.

Forex Order Book | Open Orders | Open Positions | Buy and Sell Forex | OANDA

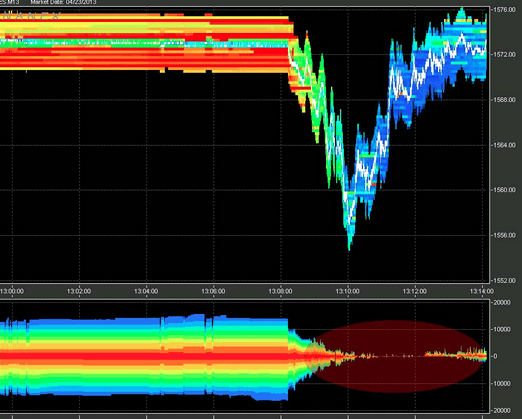

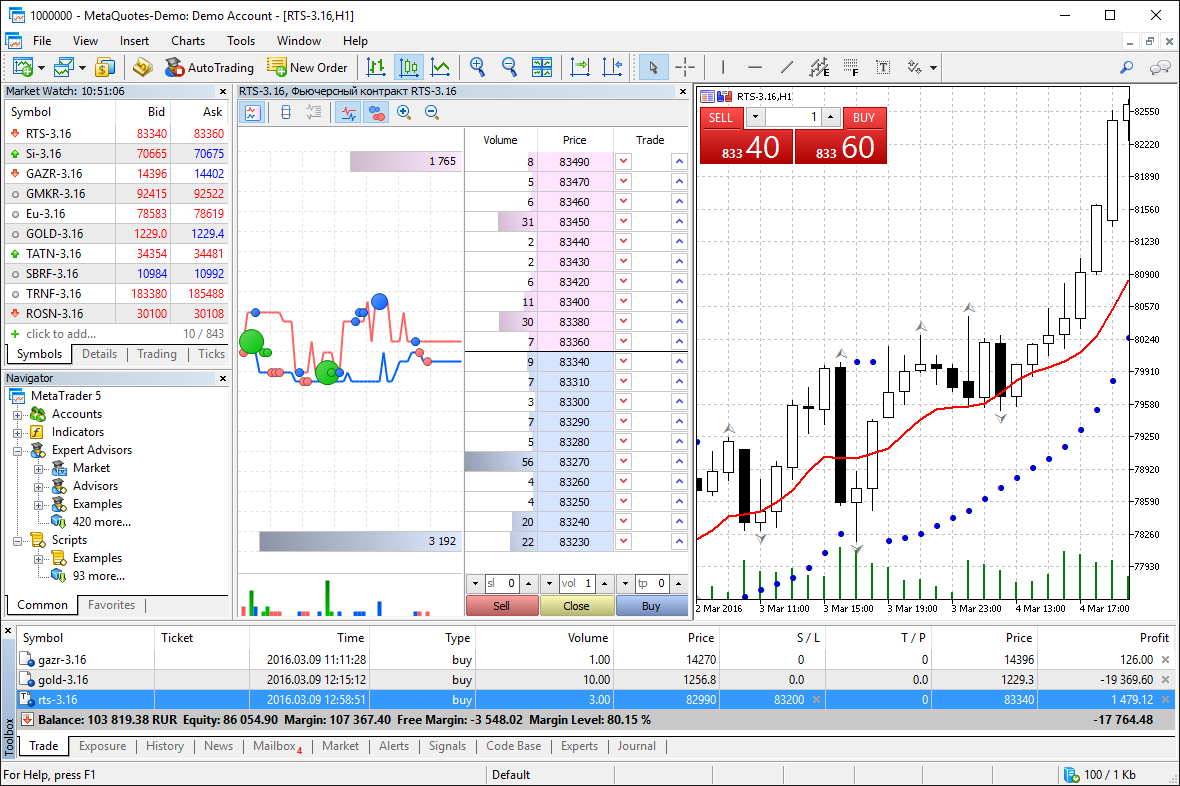

NinjaTrader and MB Trading both make market depth information available in their trading screens. It shows where all of the nearby liquidity lies.

I took this screenshot in the late afternoon when liquidity is at its worst. The best bid shows a depth ofwhich is measured in mini lots of 10, Notice, however, that most of the liquidity is further away. The net available liquidity is 8 million on the short side and 6 million on the long side for a total of 14 million.

The FX Pro screen in NinjaTrader makes it even clearer. I took this screenshot several minutes later, which is why liquidity numbers are different. The formatting makes more sense to me. Dealing in bulk actually leads to worse pricing instead of improved pricing. If you push a market order judging solely from the quote on the screen, you may get million filled at the displayed price. But, the rest of the order market depth forex trading get filled at progressively worse prices.

The traders making a market want their pound of flesh for letting someone into the market so quickly. Traders cannot see the liquidity depth of most brokers because they elect not to show it. Their platforms encourage the buy this, buy that psychology. The EURUSD is the most market depth forex trading forex pair in the world. What that means is that that is the sum quantity available 60 second binary options demo buddy 3 0 any given moment.

Some brokers hide their quantity. In forex, as an OTC market, the broker may wish to restrict the viewable book for a few reasons.

Because the broker also needs the banks to stick around when nobody wants to trade. News traders are the most likely to try trading during a thin market.

They are also the most likely to complain about not being able to trade. It has everything to do with gambling.

Retail traders are the most likely to trade during volatile events, not just news but really any type of momentum. Almost everyone follows a breakout or momentum strategy. It has everything to do with what traders perceive as the most likely outcome. When the market explodes in one direction, it takes nerves of steel to stand in front of the freight train.

My friend Afshin in Dublin fell victim to this last week. He felt like it was simply overdue for a correction. The urge to participate, rather than coming from a desire for a quick hit, instead came from a desire to be right before there was any clear indication of the opportunity to be right.

The point is that what feels natural to do is often precisely the wrong thing to do. It feels natural to every other trader, too.

Some traders run simple liquidity businesses where they receive trading rebates in exchange for accepting the risk of holding a position over the short run. These entities are less likely to concern themselves with picking the direction of the market.

Forex Market Depth - Algorithmic and Mechanical Forex Strategies | OneStepRemoved

Trading desks that make markets, however, often want the flow so that they can establish a position and earn the spread while doing so. These entities are picking direction — and they are backed by very intelligent math geeks with PhDs and a lot of time on their hands. So if everyone stacks the liquidity so that you can buy but the liquidity is thin on the short side, it should be telling you that the smart money wants to go short right now.