Buy berkshire hathaway stock b shares

The primary difference between Berkshire Hathaway Class A stock and Class B stock is one of price. Because of the price difference, Class B shares offer increased flexibility for investors and also provide a potential tax benefit.

3 Reasons Other Than Buffett to Buy Berkshire Stock

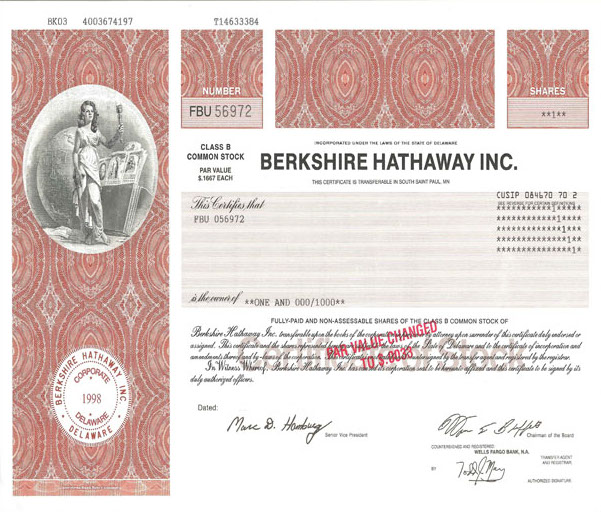

Warren Buffett has declared that the Class A shares will never experience a stock split because he believes the high share price attracts like-minded investors, those focused on long-term profits rather than on short-term price movements. InBuffett created Class B shares BRK-Boffering investors the ability to invest in Berkshire Hathaway for, initially, one-thirtieth the price of a Class A share of stock.

A to-one stock split in sent the ratio to one-1,th. Class B shares carry correspondingly lower voting rights as well. Buffet stated that the purpose of creating the Class B shares was to give smaller investors the opportunity to invest directly in Berkshire Hathaway, rather than only participating indirectly through mutual funds that mirror Berkshire Hathaway's holdings.

One benefit of holding Class B shares is flexibility. If an investor owns just one share of Class A and is in need of some cash, the only option is to sell that single share, even if its price far exceeds the amount of capital the investor needs to access. In contrast, a holder of Class B shares can liquidate part of his or her Berkshire Hathaway holdings, just up to the amount needed to meet cash flow requirements.

Another benefit of Class B is that its much lower price means that BRK stock can be passed to heirs without triggering the gift tax as passing Class A shares does.

One final difference is that Class A shares can be converted into an equivalent amount of Class B shares any time a Class A shareholder wishes to so do. The conversion privilege does not exist in reverse. Class B shareholders can only convert their holdings to Class A by selling their Class B shares and then buying the equivalent in Class A shares.

Get into the mind of Warren Buffett. How He Does It. Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Buy berkshire hathaway stock b shares to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost Usd ytl forex Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. What is the difference between Berkshire Hathaway's Class A and Class B shares? By Investopedia Updated May 10, — 7: Learn why Warren Buffett created Class B shares of its highly priced Berkshire Hathaway stock and how this information is Understand Warren Buffet's fundamental approach to investing and learn why his basic investment strategy scalping forex techniques his no-split Discover how a company can break down its common stock into multiple classes and how these classes differ from one another Learn how a class C share differs from a class A or B share in relation to a mutual fund.

Class B shares are one classification of common stock issued by corporations. Learn how much you would now have if you had invested right after Berkshire Hathaway's IPO, day trades optionshouse find out buy berkshire hathaway stock b shares classes of shares that you could invest in.

Berkshire Hathaway shareholders have done well over the years. Today's shareholders include some of the world's largest asset managers and pension funds. Discover how Warren Buffett's Berkshire Hathaway is structured and if the company is appropriate for individual retirement accounts. The meaning of share classes varies, depending on the investment vehicle.

What does that mean for Berkshire Find out why Berkshire Hathaway stock may be undervalued when the company has an overall growth business, something that should support a premium valuation. Mutual funds are a popular investment for retirement.

Error (Forbidden)

Here's how to choose the best share class when investing in them. With its share price at an all-time high amid talk of a stock market correction, why would anyone buy Berkshire Hathaway shares?

There are three main mutual fund classes, and each charges fees in a different way. An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation.

Berkshire Hathaway B Shares Are Undervalued - Cramer's Lightning Round (1/11/17) | Seeking Alpha

A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers.

Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.